The Debt Crisis: Eye-Opening Statistics

At Monetary Ally, we believe that understanding the scope and impact of debt is crucial for taking steps towards financial freedom. Here are some compelling statistics that highlight the debt challenges many people face today.

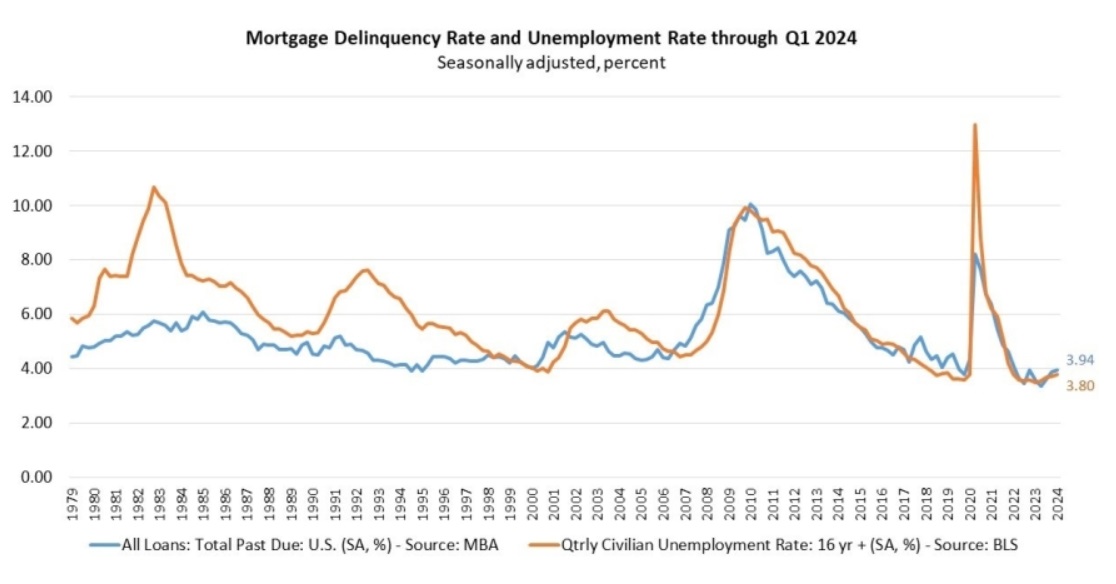

Mortgage Delinquencies Up 38 Basis Points YOY In Q1 2024

In the first quarter of 2024, mortgage delinquency rates rose, with significant year-over-year increases particularly in FHA and VA loans. The Mortgage Bankers Association (MBA) survey revealed a six basis point increase in the overall delinquency rate from the fourth quarter of 2023 and a 38 basis point increase from one year ago. Conventional loan delinquencies rose one basis point to 2.62% from the previous quarter. FHA loan delinquencies fell by 42 basis points to 10.39%, while VA delinquencies jumped 59 basis points to 4.66%.

Year-over-year, total mortgage delinquencies increased across all loan types: 18 basis points for conventional loans, 112 basis points for FHA loans, and 68 basis points for VA loans. MBA’s Vice President of Industry Analysis, Marina Walsh, noted, "Overall mortgage delinquencies increased slightly in the first quarter of 2024, but not across all three major loan types. Delinquencies declined for FHA loans, were relatively flat for conventional loans, and increased for VA loans." She attributed these trends to higher unemployment, lower personal savings, rising property taxes and insurance, and increased credit card debt and delinquency, which have made it more challenging for some homeowners to meet their mortgage payments.

In the first quarter of 2024, mortgage delinquency rates rose, with significant year-over-year increases particularly in FHA and VA loans.

The percentage of loans in the foreclosure process at the end of Q1 was 0.46%, down one basis point from Q4 2023 and 11 basis points from one year ago. Walsh explained that the delinquency rate includes loans at least one payment past due, excluding those in foreclosure. She also mentioned the Department of Veterans Affairs' foreclosure moratorium until May 2024, which contributed to the rise in delinquent VA loans that are not yet in foreclosure.

By stage, the 30-day delinquency rate increased by 15 basis points over Q4 2023 to 2.25%, the 60-day delinquency rate decreased by six basis points to 0.67%, and the 90-day delinquency rate decreased by three basis points to 1.02%. There was a decline in seriously delinquent loans: conventional loans decreased by six basis points, FHA loans by 24 basis points, and VA loans remained unchanged from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased by 21 basis points for conventional loans, 83 basis points for FHA loans, and 25 basis points for VA loans.

States with the largest year-over-year increases in overall delinquency rates included Louisiana and South Dakota (96 basis points each), New Mexico (71 basis points), Texas (66 basis points), Georgia (56 basis points), and North Dakota (56 basis points).

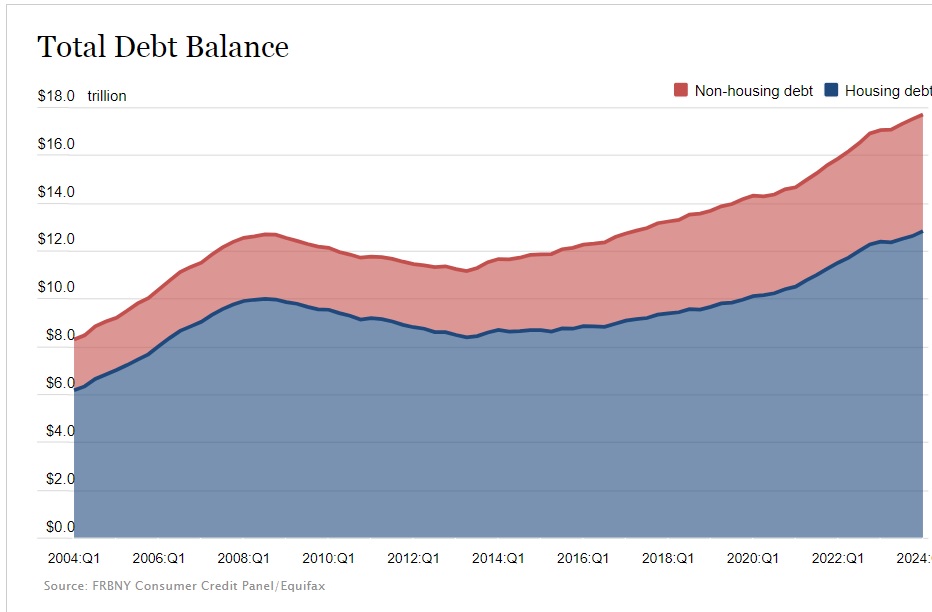

Household Debt Climbs to $17.69 Trillion in First Quarter; Delinquency Rates Rise Again

Total household debt rose by $184 billion to reach $17.69 trillion, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances increased by $190 billion to $12.44 trillion, while balances on auto loans climbed $9 billion to $1.62 trillion, continuing their upward trajectory. Credit card balances declined, as is typical for the first quarter, falling by $14 billion to $1.12 trillion. Nearly 9 percent of credit card balances and 8 percent of auto loans (annualized) transitioned into delinquency.

As of Q1 2024, U.S. household debt reached a record high of $17.69 trillion. This includes mortgages, credit cards, auto loans, student loans, and other forms of debt.

Americans Facing Rising Credit Card Debt Amid High Inflation and Interest Rates

The latest data from TransUnion reveals that the average debt per borrower reached $6,218 at the end of the first quarter of this year, marking an 8.5% increase from one year ago. Collectively, consumers now owe a staggering $1.02 trillion in credit card debt.

Consumers are managing expenses amidst stubbornly high inflation, and demand for credit continues to be strong despite the currently relatively high interest rates.

Many households are experiencing a significant rise in monthly expenses due to the ongoing inflation crisis. While the consumer price index has decreased from its peak of 9.1%, it remains substantially higher than pre-pandemic levels. Compared to January 2021, before the sharp increase in prices, inflation has surged more than 18%.

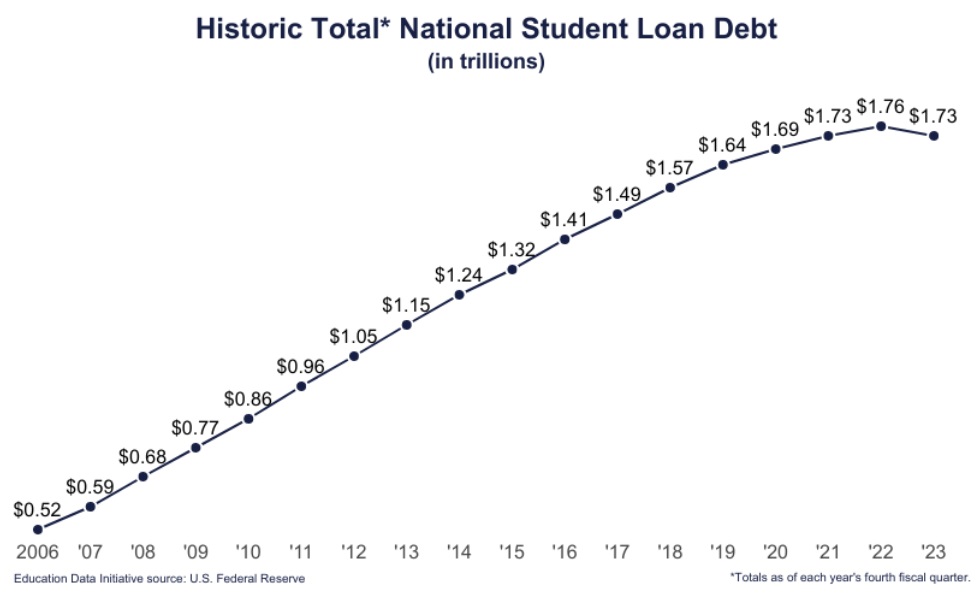

Student Loan Debt Declines - That's How Bad It's Getting

In 2023, student loan debt in the United States saw its first-ever annual decline, totaling $1.727 trillion. Federal loans constitute $1.602 trillion, or 92.8%, of this debt. There are 43.2 million federal loan borrowers, with an average debt balance of $37,088. When including private loans, the average total balance can reach $39,981. Notably, less than 2% of private student loans defaulted in the fourth quarter of 2021. On average, students at public universities borrow $32,637 to earn a bachelor's degree.

There are 43.2 million federal student loan borrowers, with an average debt balance of $37,088.

It's Time to Stop this Cycle!

At Monetary Ally, we are here to help you navigate these challenging financial times. Our expert consultants offer personalized strategies to manage debt effectively and build long-term wealth. If you're feeling overwhelmed by rising expenses and debt, contact us today to start your journey towards financial stability and independence.